As a nation, we have the mammoth task of ensuring that our children become a financially informed generation that is entrepreneurial.

However, we cannot overlook the fact that the topic of finances often comes off as too serious and therefore boring to children.

So how best can we ensure that we carry across these teachings in a way that they will stick with our kids? Fin-Edu believes that there is no better way than through play!

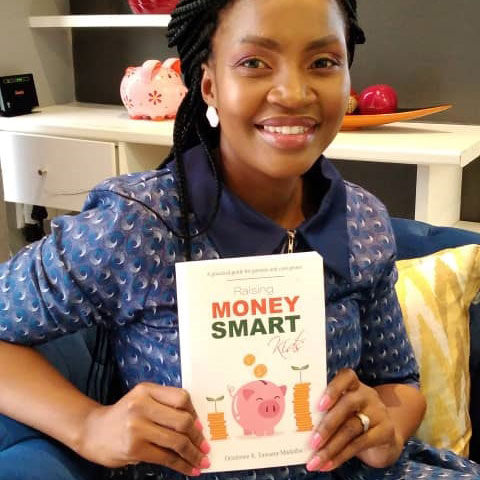

Founded in 2018 by Otisitswe Tawana-Madziba, Fin-Edu is a social enterprise that is aimed at empowering children and teenagers with financial literacy and entrepreneurship skills with a key mandate of making learning about money and business fun.

“Given children learn best through play, the idea was to leverage on that and incorporate play in their learning” she said.

She explained that another important aspect in their initiative is the environment in which children are taught. “We ensure that the space we use is a safe and fun space where kids can enjoyably learn. We do not use chairs and tables but rather yoga mats or picnic tables to better give the children freedom to express themselves and their brilliant ideas.”

From its initiation, Fin-Edu was set on providing financial literacy to everyone but in 2021, they pivoted and targeted children from an early age. “Inculcating such a mindset of financial literacy from an early age is critical because habits take time to form, the earlier children form healthy money habits the longer they will stick with them into adulthood.”

Contrary to what most parents believe, that children are too young to learn about money, studies have shown that children’s money patterns and habits are established by age 7, which is why Fin-Edu targets children from ages 5-18 years.

A mother herself, Tawana-Madziba says she started with her two kids because she wanted them to do better financially and to have an entrepreneurial mindset. “After noting the incredible results, I was inspired and wanted this to be something that most parents practice.”

In store for 2023, Fin-Edu will be launching a 6 months financial literacy and entrepreneurship programme to offer children a more consistent learning. “This is important because it would give us the opportunity to teach and monitor their development and growth in their learning process and ensure that the habits they learn stick, unlike a one day programme.”

She has advised that teaching kids about financial literacy is a long term investment which will reap great rewards in children’s lives. She says it gives her great joy to note that children are now more eager to learn about money, and to save and start their own businesses and are committed to seeing their savings grow.