Resolute De Beers still cooking despite all-time low

Amidst dwindling diamond sales and weak demand, mining giants, De Beers remains unfazed, confident that the good times will return.

Prices for rough diamonds have dipped drastically in 2023, as many post-pandemic consumers shy away from luxury goods.

The price cuts follow two record-breaking years in rough diamond sales, when demand for natural diamond jewelry was at an all-time high.

After the feast has come the famine!

Although the dip in demand has left diamond buyers stuck with swelling inventories, De Beers Group Chief Executive Officer (CEO) Al Cook revealed their production targets have remained unchanged, with parent company Anglo American sticking to the original 30-33 million carats goal.

“We are keeping production targets constant despite being in a challenging down turn in the diamond demand. The reason we are doing this is principle and confidence in the long term value of natural diamonds. We believe the market will come back remarkably and get stronger as it has always done,” said Cook on the sidelines of the 2023 Natural Diamond Summit in Gaborone this Monday.

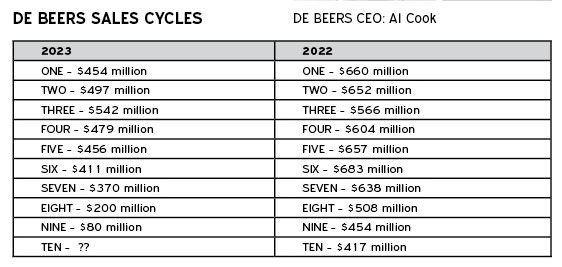

Cook’s defiance comes after a ‘disastrous’ Cycle 9 (October 4th – November 3) for De Beers, which saw $80 million made from sightholders and auctions.

It is the lowest amount recorded in a single cycle since De Beers started making such information public in 2016, smashing the previous record of $116 million in Cycle 6 of 2020.

It also means that this year, every single rough sales cycle has been less than its corresponding cycle from 2022.

“Supply of natural diamonds is going down and demand will go up. When supply is going down and demand is up it means a very healthy prospect. So because of our confidence in the long term future of natural diamonds we continue to produce in the same way outlined in our values and build up stocks because we are confident that overtime the diamond prices will increase and we will be able to sell that supply into the growing demand,” continued Cook, who pointed to China and India as reason for optimism.

“With more than 100 million people entering the middle class in China and India over the next decade, diamonds will remain sought after. Despite a slowdown this year, the foundations of natural diamonds remain strong. The diamond industry is not immune, and 2023 has been an exceptionally difficult year as global forces have conspired to slow trading across the diamond pipeline,” he said.

Despite the CEO’s confidence, De Beers suspended all online rough auctions through the end of the year in an effort to stabilize the slow market.

Earlier this year, De Beers was forced to combine its May and July auctions as weak consumer spending in the US and China dampened manufacturers’ demand for rough diamonds.

As a result, government owned Okavango Diamond Company are feeling the heat too.

ODC, which has access to 25 percent of goods from the country’s Debswana joint venture with De Beers, saw 62 out of 148 lots go unsold at its May spot auction.

According to the latest figures, 66 out of 115 lots from the rough diamond marketing company failed to find a buyer during the September spot auction.

Further, the November auction has been suspended as there is still much uncertainty on whether the December sales auction will go ahead.

The situation echoes the chaos of 2020, when the breakout of Covid-19 hit demand hard, as did the global economic recession of 2009 and 2015.

Diamonds bounced back from these setbacks; Cook and co are confident they will again!